Performing business in the UAE today is definitely not as it used to be. Things have indeed changed. A lot.

With Corporate Tax now in place and VAT compliance still very much active, SMEs are under more pressure than ever before to get their numbers right. Literally every figure matters. Every report counts. And honestly, relying on spreadsheets or disconnected accounting tools just doesn’t cut it anymore.

Too many files, too many versions, too many pending errors.

At CloudSync Technologies, certified Odoo implementation partners in Dubai, we believe your Odoo ERP software should do more than record transactions. It should protect your business. It should guide compliance. It should make life easier.

This guide explains how Odoo ERP will help the SMEs manage Corporate Tax and VAT without stress.

Mastering UAE Corporate Tax with Odoo ERP

The Ministry of Finance’s introduced UAE Corporate Tax system applies directly to a company’s net profit, meaning revenues minus allowed expenses.

That sounds doable. When data is all over the place, that’s when things get seriously out of hand.

Therefore, the balance has to be there in addition; the UAE tax framework follows international standards for supporting small businesses.

Two Tier Tax System

Odoo’s UAE localization is designed to handle Corporate Tax out-of-the-box. No complicated setup. No guesswork.

- 0 percent band

Applied on the first AED 375,000 of taxable profit. This leaves SMEs with breathing space. - 9 percent band

Applied to any profit above AED 375,000.

Odoo does this for you in the background, quietly. You don’t have to chase numbers.

Why Automation Matters So Much

Without an integrated ERP, Corporate Tax compliance becomes slow and risky.

Businesses fall short when it comes to keeping proper track of expenses.

Non-deductible expenses get mixed in.

The finalization of the Profit and Loss statements is incredibly long.

Manual work leads to mistakes. And mistakes can be expensive.

How Odoo Handles Corporate Tax

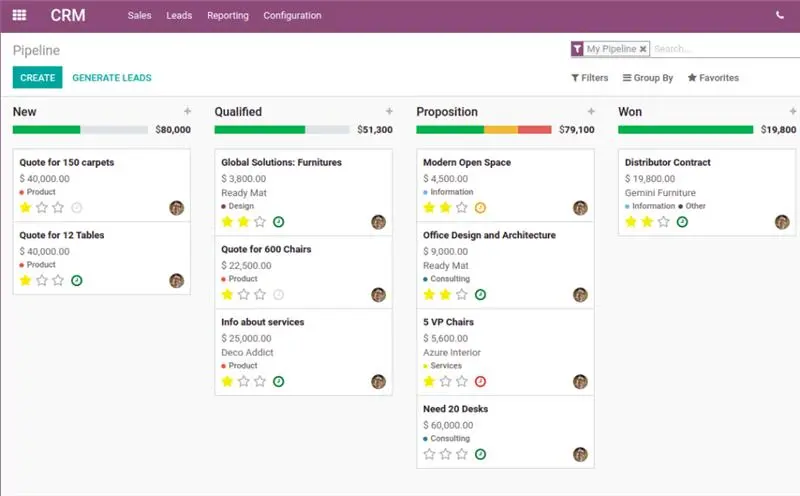

Odoo’s accounting module ties all of this together: Sales, Purchases, Expenses – all tied to the Chart of Accounts.

This allows Odoo to:

- Track net profit in real time

Revenue and expense figures automatically update during the year. - Generate instant reports of Corporate Tax

Odoo calculates the taxable profit, applies the appropriate rate, and shows the final liability. - Be always audit-ready

Reports are exportable as PDF or Excel at any moment. Clean. Clear. Reliable.

With Odoo ERP in Dubai, Corporate Tax becomes structured and predictable for the SMEs. No panic at the end.

Streamlining the VAT Returns at 5 Percent

VAT has been here for a while in the UAE. Still, it doesn’t mean things are easy.

Many SMEs are still battling with VAT filing. The same old issues just keep appearing and reappearing. Wrong tax codes. Bank reconciliation that is not timely. Difference in accounting data and FTA returns. And penalties? They don’t wait.

Odoo’s FTA Certified VAT Solution

Odoo is officially certified by UAE Federal Tax Authority: that itself builds trust. More importantly, it makes VAT smooth flowing, not an ongoing headache.

VAT Automation Inside Odoo

- In-built tax configuration

Odoo applies the right VAT tags on sales and purchase entries automatically. Output VAT and Input VAT are always tracked well. - Live VAT dashboard

No need to wait until quarter-end. Finance teams can view in real time the expected VAT payable. - Automated bank reconciliation

Odoo connects with bank feeds and automatically matches transactions. This will maintain up-to-date and accurate VAT reports. - FTA compliant VAT return export

VAT returns can be previewed and exported in the format mandated by FTA. Faster filing. Reduced errors.

With Odoo ERP in Dubai, VAT compliance feels controlled. And calmer.

Odoo Implementation: Strategic in Dubai and the UAE

ERP implementation isn’t about just installing software. Especially when compliance gets thrown into the mix. Local rules make a difference. Experience does matter.

CloudSync Technologies will implement a structured approach to implementation designed for the UAE business environment.

Our Implementation Focus

- Odoo Migration and Localization

We install UAE-specific modules such as Corporate Tax and accounting reports. The Chart of Accounts is aligned for compliance. - Odoo integration across departments

Sales, inventory, purchasing, and finance work as one system. Tax reports reflect actual business activity. - Odoo Development and Customization

Using Odoo Studio, we do workflow and reporting customization for various industries. Import export. Trading. Services. All covered. - Odoo software training and support

Teams are well-trained. We remain present for support and updates after go-live as regulations change.

Choosing a certified Odoo partner means predictable Odoo ERP pricing and fewer surprises later.

CloudSync Technologies: Your Trusted Odoo Partner in the UAE

What the businesses are looking for when in need of the best Odoo ERP software in UAE is reliability, clarity, and local expertise. That’s where CloudSync Technologies comes in. Our ERP systems are built to support both growing SMEs and complex enterprise operations, without limitations.

What We Deliver

- Flexible and integrated ERP systems

- Customizable solutions for smarter decisions

- Full visibility into the business in one platform

- Higher ROI with integrated operations

Odoo Covers Your Entire Business

- Supply chain management

- Inventory and warehouse

- Professional services management

- Buying Finance management

- Business Intelligence

- Human Capital Management

- Customer relationship management

- Integration with numerous apps

Our Odoo Services

- Odoo migration

- Odoo consultation

- Odoo Development

- Odoo customization

- Odoo software training

- Odoo technical training

- Odoo apps implementation

We are certified Odoo partners in the UAE offering on-site and remote training. CloudSync Technologies is one of the leading Odoo ERP partners in the UAE.

Reach out for a free consultation today and see how Odoo simplifies compliance, sanitizes operations, and supports growth